GCIOSGF Newsletter 會訊

We have learned about the economy of the world in June and July from the UN.

Global growth prospects have weakened significantly amid the war in Ukraine

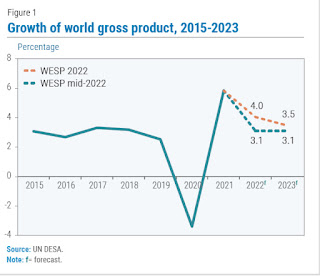

The World Economic Situation and Prospects as of mid-2022 warns that the global economy may be on the cusp of a new crisis, while still recovering from the pandemic. The war in Ukraine has upended the fragile global recovery, triggering a devastating humanitarian crisis in Europe, pushing up food and commodity prices, slowing growth globally and exacerbating inflationary pressures worldwide. Geopolitical and economic uncertainties are dampening business confidence and investment and further weakening short-term economic prospects. Against this backdrop, the world economy is now projected to grow by only 3.1 per cent in 2022 and 2023 (figure 1), marking substantial downward revisions of 0.9 and 0.4 percentage points, respectively, from our previous forecasts released in January 2022. Our baseline outlook faces major downside risks from further intensification of the war in Ukraine , new waves of the pandemic, and faster-than-expected monetary tightening by developed country central banks .

The downgrades in growth prospects are broad-based. Growth in the United States is forecast to slow to 2.6 per cent in 2022 due to high inflationary pressures, aggressive monetary tightening by the Federal Reserve and a strong US dollar, which is weighing on net exports . In China, GDP is projected to expand by 4.5 per cent, a downward revision of 0.7 percentage points, with stringent zero COVID-19 policies adversely affecting growth prospects. Meanwhile, there is an exceptionally heavy toll on the economy of the European Union: Its GDP is projected to expand by 2.7 per cent in 2022, 1.2 percentage points lower than expected in January.

The economic prospects for the Commonwealth of Independent States and Georgia are also sharply downgraded. The Russian Federation's economy is projected to contract by about 10 per cent in 2022. Amid massive destruction of infrastructure, population displacement and disruption of economic activities, the Ukrainian economy is projected to contract by 30 to 50 per cent in 2022.

The outlook for developing countries has also deteriorated, with GDP projected to increase by 4.1 per cent in 2022, 0.4 percentage points lower than forecast in January. Higher energy and food prices, rising inflationary pressures and slowing growth in the United States, the European Union and China are weakening their growth prospects. The monetary tightening in the United States will sharply increase their borrowing costs. A growing number of developing countries – including several least developed countries – face stagnant growth prospects and rising risks to sustainable development, amid high levels of debt distress. The negative outlook is compounded by worsening food insecurity, especially in Africa and Western Asia. Additionally, lower vaccination rates make developing countries more vulnerable to new waves of COVID-19 infections. By the end of April 2022, the number of doses per 100 people in the developed countries stood at 190.8, compared to 143.5 in developing countries and only 35.5 in Africa.

The war in Ukraine and the sanctions against the Russian Federation have rattled commodity markets, exacerbating supply-side shocks. In 2022, global trade growth is projected to slow down markedly, after a strong rebound in 2021. The conflict has directly disrupted exports of crude oil, natural gas, grains, fertilizer and metals, pushing up energy, food and commodity prices (figure 2). The Russian Federation and Ukraine are key suppliers of agricultural goods, accounting for 25 per cent of global wheat exports, 16 per cent of corn exports and 56 per cent of exports of sunflower oil.

The world economy is facing substantial inflationary pressures. Global inflation is projected to increase to 6.7 per cent in 2022, twice the average of 2.9 per cent recorded during 2010–2020 (figure 3). Headline inflation in the United States has reached the highest level in four decades. In developing regions, inflation is rising in Western Asia and Latin America and the Caribbean. Soaring food and energy prices are having knock-on effects on the rest of the economy, as reflected in the significant rise in core inflation in many economies as well.

Rising inflation is posing an additional challenge to an inclusive recovery as it disproportionally affects low-income households that spend a much larger share of their income on food items. The decline in real incomes is particularly pronounced in developing countries, where poverty is more prevalent, wage growth remains constrained, and fiscal support measures to alleviate the impact of higher oil and food prices on the vulnerable groups are more limited. Surging food inflation is worsening food insecurity and pushing many below the poverty line as developing countries are still struggling with economic shocks from the pandemic.

沒有留言:

張貼留言